Understanding percentage increases is a crucial skill applicable across various fields, from personal finance to complex business analytics. This guide provides a clear, step-by-step approach to mastering percentage calculations, empowering you to confidently interpret and utilize this fundamental concept.

Increase by Percentage: Mastering the Math of Growth

Calculating percentage increase involves determining the proportional growth between an initial value and a final value. Understanding this allows for insightful comparisons and informed decisions.

Getting Started: The Basics of Percentage Increase

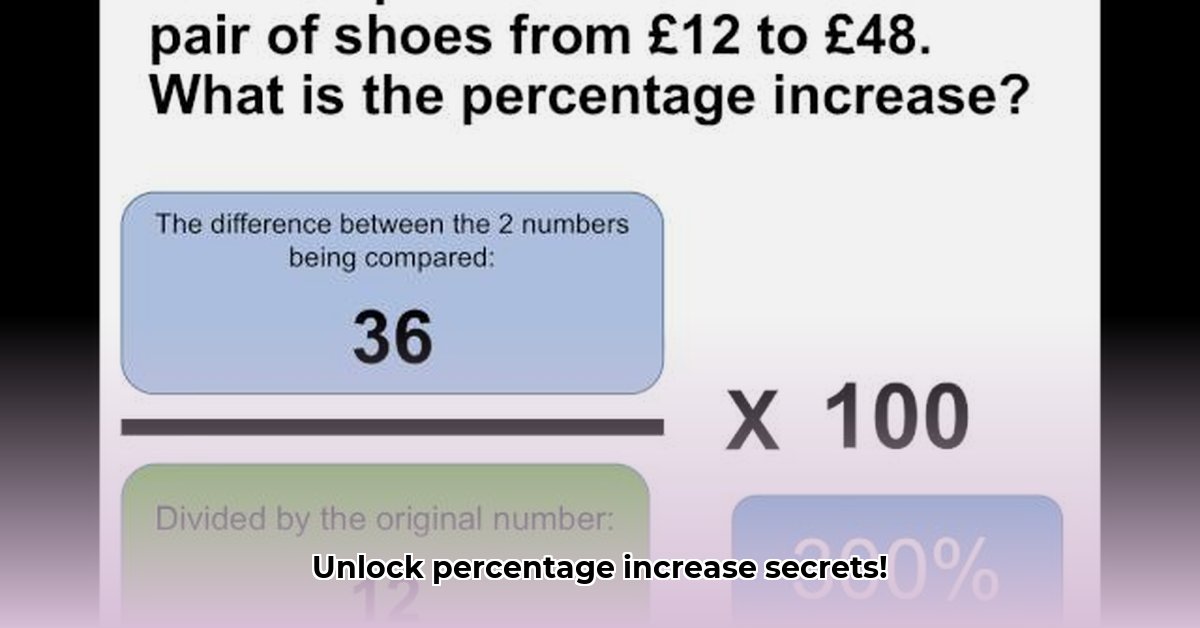

The fundamental formula for calculating a percentage increase is remarkably simple: [(New Value - Old Value) / Old Value] * 100. This formula yields the percentage change from the initial ("old") value to the final ("new") value. A positive result indicates an increase, while a negative result indicates a decrease.

For instance, if a product's price rose from $10 to $15, the percentage increase is [(15 - 10) / 10] * 100 = 50%. This clearly illustrates a 50% price hike.

Percentage Points vs. Percentage Change: A Crucial Distinction

It's vital to differentiate between "percentage change" and "percentage points." Consider an interest rate climbing from 2% to 5%. The percentage change is [(5 - 2) / 2] * 100 = 150%. However, the increase in percentage points is simply 3 (5% - 2% = 3%). This distinction is crucial for accurate and unambiguous communication. Misunderstanding this difference can lead to inaccurate interpretations and potentially flawed decision-making. Have you ever encountered this confusion in financial reporting?

Comparing Values: Percentage Differences

To determine the relative difference between two values regardless of which is larger, use this formula: [|Value 1 - Value 2| / ((Value 1 + Value 2) / 2)] * 100. This provides the percentage difference between the two numbers. For example, if Company A's profits are $100,000 and Company B's are $150,000, the percentage difference is [|100,000 - 150,000| / ((100,000 + 150,000) / 2)] * 100 = 40%. This highlights a substantial difference in profitability. How does this application help you analyze and compare data across different datasets?

Real-World Applications: Percentage Increases in Action

The utility of percentage increase calculations extends across numerous fields:

- Finance: Tracking investment growth, assessing returns on investments (ROI), and identifying market trends are all facilitated by percentage calculations.

- Business: Analyzing sales performance, understanding pricing strategies, and measuring the effectiveness of marketing campaigns are critically dependent on accurate percentage calculations.

- Healthcare: Monitoring patient improvement, evaluating treatment efficacy, and studying disease trends rely heavily on percentage-based analysis.

- Science: Analyzing experimental results, making comparisons between data sets, and clearly presenting research findings often require percentage increase calculations.

Potential Pitfalls and Best Practices

While seemingly straightforward, percentage calculations can be prone to errors. Rounding numbers prematurely can lead to inaccuracies, especially in complex calculations. It's best to maintain a sufficient number of decimal places throughout calculations, rounding only the final result. Context is paramount; a 1% profit increase might be significant for a small business but negligible for a large corporation. What strategies can one employ to avoid calculation errors and ensure data accuracy?

Leveraging Technology for Efficiency

Manual calculations can be time-consuming. Spreadsheets (e.g., Excel, Google Sheets) provide built-in percentage formulas offering efficiency and accuracy. Numerous online calculators offer specialized functionality for percentage calculations. Selecting the appropriate tool significantly streamlines the process and reduces the likelihood of errors.

How to Calculate Percentage Increase with Compound Interest

Understanding compound interest is crucial for long-term financial planning. It represents the interest earned not only on the principal amount but also on accumulated interest from previous periods. This creates exponential growth over time.

Understanding Compound Interest

Unlike simple interest, which only calculates interest on the principal, compound interest generates a snowball effect. The interest earned in each period is added to the principal, becoming part of the base for calculating interest in the subsequent period. This compounding effect accelerates growth significantly over time.

Methods for Calculating Compound Interest

Two primary methods exist for calculating compound interest:

1. The Iterative Method: This method is intuitive and demonstrates the compounding effect clearly. It involves calculating the interest earned for each period and adding it to the principal before proceeding to the next period.

2. The Formula Method: This provides a more efficient approach, particularly for longer periods. The formula is: A = P (1 + r/n)^(nt), where:

- A = future value

- P = principal

- r = annual interest rate (decimal)

- n = compounding periods per year

- t = number of years

Pros and Cons of Each Method

| Method | Pros | Cons |

|---|---|---|

| Iterative | Clear, easy to understand | Time-consuming for numerous periods |

| Formulaic | Efficient, particularly for long periods | Can obscure the compounding process visually |

Choosing the Right Method

The ideal method depends on individual needs. The iterative method facilitates understanding the compounding process, while the formula method is best suited for quick calculations, particularly over long durations or with frequent compounding.